RealtyDAO Token Economics

RealtyDAO Token Overview

rDAO tokens are access and utility tokens to the RealtyDao blockchain platform. RDAO under the hood is a hybrid platform of headless cms, and smart contracts that implement token ownership rights using eShares protocol, and our Contrib protocol.

Token Distribution

Token Details

Ticker: rDAO Binance

Max Supply: 1B

Total Supply: 1B

Initial Circulating Supply: 300M

Public Launch Allocation: 2M

Public Launch Price: $0.50

Token Distribution and Allocation

Default Pie breakdown for RDAO including each DNA. All assets when tokenized in our platform will automatically have the assigned 1million ESH tokens.

- Asset (DNA) = 30%

- Community/Partnerships = 30%

- Treasury = 18%

- Team = 10%

- Liquidity = 10%

- Impact Program = 2%

Please read our terms and agree with the full understanding that RDAO tokens being offered are access and utility tokens to the network and should not be earned or acquired with the intention of redistribution outside the network.

RealtyDAO has only raised the most necessary funds to get the Product Development going and to give the rDAO token the right kickstart in terms of Liquidity, Exchange listings and Marketing

While all Team, Advisor and Foundational tokens are locked for at least 1 year, the rest of the tokens are allocated to the Token Sale, as well as to Liquidity Provision and Marketing actions.

RDAO DISTRIBUTION

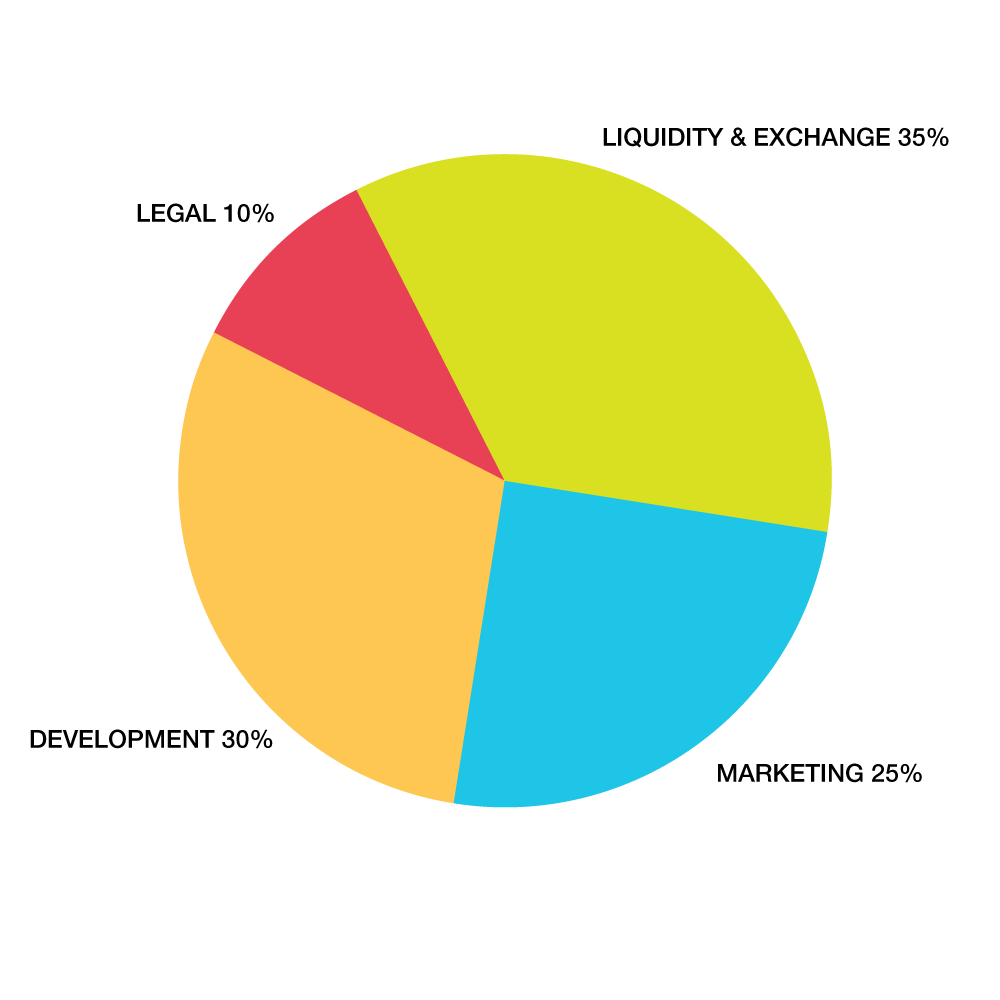

USAGE OF FUNDS RAISED

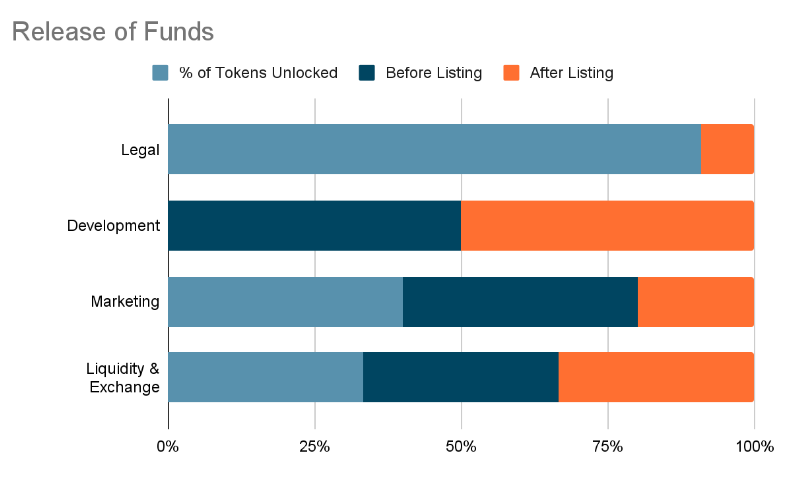

Token Release Schedule

Release details

- Legal: 50% unlocked before listing, then 10% monthly over 5 months.

- Development : 50% locked before listing, then 50% after 1 year

- Marketing : 50% unlocked before listing, then 50% after 6 months

- Liquidity: 50% unlocked before listing, then 8.3% spread out in 6 months

Technical Details

Transaction Processing and Computation

As a decentralized network, RealtyDao charges users – or the apps they’re using – for services on a per-action basis, similar to the way Amazon Lambda charges for processing power today.

There are two types of fees on the rDAO network:

- Processing fees cover the fees for a transaction to be submitted and included in a block.

- Computation fees are added for more complex operations that require computation beyond updating balances.

PROOF-OF-CONTRIBUTION PROTOCOL

The Proof-of-contribution protocol is the aggregate of two platforms, eShares our automated liquidity cap management tool and Contrib, our contribution protocol, working together in the same node to deliver instantaneous data for RealtyDAO and it’s portfolio of assets.

These data are based on our contribution model

- Service and

- Liquidity Contributions

With the contribution model, we can now assess how to evaluate and compute for an assets’ theoretical value.

Dynamic liquidity cap is used to determine exactly the right number of eShares each person deserves based on the theoretical value of their individual inputs. The eShares remains flexible until a ‘transaction’ occurs such as external investment or completed contribution when the evolving breakdown of equity ownership distribution needs to be calibrated.

Digital Native Assets’s Eshares and TV(Theoretical Value)

Theoretical Value is a number used to measure the value of an asset or transaction at a specific time. Theoretical value is close to the real value but only used to calculate distribution rights upon triggered transactions within Contribs dynamic liquidity split system.

Theoretical Value of Domain

Calculated using the following domain criteria:

- Price value

- Number of team members

- Leads

- Social pages

- Social engagements

- Content

- Partners

- Monetization

TVL = CURRENT TV+NEW CONTRIB VALUE/HARDCAP ESH NUMBER OF TOKENS

The theoretical value of the domain is based on the total number of contributions priced at USD value and divided by the number of eSh tokens, which is hard capped at 1M Esh per Domain/DNA.

Every contribution to the domain will always add value to the asset. This is the basis of our Contrib/eSh Math Valuation.

Liquidity Types and Distribution

This is the percentage given to different contributors/member per domain. By default:

- Investor = 50%

- Crowd = 18%

- Open = 15%

- Partnerships = 15%

- Charity = 2%

To note:

- Every domain can have different eshare type percentage value.

- A member can be in different eshare type in different domains.

Price and Contribution Stabilization mechanism

To strengthen the core function of rDAO and each DNA’s eSH, it is important to manage the threats aligned to common crowdsale contracts. This is the sole reason why our REALTYDAO contracts are inflation-resistant and anti-whale. You cannot own a certain percentage of a DNA without the owners’ permission. You cannot buy rDAO.

The contribution stabilization consists of performing a control in withdrawal and unstaking of rDAO tokens, operated by the RealtyDao Smart Contract managing the token’s price fluctuations in itself, activating automatic suspensions of transferability, unstaking in order to counteract any uncontrolled volatility.

This approach entails the need to provide token pricing to the Smart Contract, which requires for centralized exchanges the usage of oracles.

Monetary policy

Premined distribution

Crowdsale: Part of the initial supply will be sold through a public token sale to investors and initial owners of the rDAO token.

Airdrop: Part of the initial supply will be distributed to the community in exchange for small contribution tasks via Contrib.