Introduction

RealtyDao is a Decentralized Holding and Development Platform for Digital Native Assets (DNA) on the blockchain.

RealtyDAO brings to Defi, tokenized digital native assets like domains and top-level domains.

RealtyDao’s focus is

1. Tokenize

2. Automate

3. Create liquidity

With RealtyDao, you can

✔️ Own a claim of premium RealtyDAO tokenized Digital Native Assets

✔️ Add your DNA for tokenization and into our defi blockchain platform

✔️ Leverage a Stable Appreciation Mechanism across assets

RealtyDAO is unique with our ability to lean into DEFI by leveraging the 20,000 premium and historical DNA like Referrals.com, Applications.com, eShares.com, and others. RealtyDAO has established relationships with industry-leading assets owners and built a custom multi-protocol, blockchain platform for digital native assets with tools that create value, automates contribution, and provides liquidity.

Classes of Digital Native Assets

RealtyDao has various Digital Native Assets or (DNA's) and these are:

Top level domains by Handshake

Top level domains by Handshake

Premium URL’s

Premium URL’s

NFT/Tokens

NFT/Tokens

THE RDAO TOKEN

RDAO under the hood is a hybrid platform of headless cms, and smart contracts that implement token ownership rights using eShares protocol, and our Contrib protocol.

rDAO Token features :

✔️ rDAO token represents our platform’s native utility token with an underlying token pegged to the USD 1:1.

✔️ rDAO is non-inflationary. All tokens have been pre-mined and the supply is fixed (at 1 billion tokens).

✔️ rDAO uses a Proof-of-Contribution model wherein every rDAO token holder is a contributor and every contribution pegged to the US dollar.

Please read our terms and agree with the full understanding that RDAO tokens being offered are access and utility tokens to the network and should not be earned or acquired with the intention of redistribution outside the network.

ESHARES PROTOCOL

ESHARES PROTOCOL

eShares.com is an integrated and semi-automated stake table management system for digital assets. The flexible and secure application is a simple and effective feature managing some of the worlds best digital assets including Handyman.com, Mergers.com, Staffing.com and others. Integrated into the VNOC tech stack and Contrib network, eShares focuses on managing individual and performance based value creation, contractual agreements and compensation for over 20,000 assets.

The concept of programmable money and programmable equity together push us into a world where unprecedented value can be created by autonomous value-creating networks, managed by eShares.com.

The Implementations of ESH within the network allows for easy and instantaneous share computation for each contribution to a digital asset.

Each RealtyDAO that is brought into the marketplace will have its own ESH value which depends on it’s assumed Theoretical Value, (TV ) thereby measuring the claim you have on the asset.

Theoretical Value (TV) is calculated using the following DNA criteria :

1. Initial Value

2. Team

3. Users

4. Social

5. Monetization

6. Data

7. Partnerships

The ESH PIE

Default Pie breakdown for each DNA. All assets when tokenized in our platform will automatically have these assigned ESH tokens which the owner can still move to his desire. But for the sake of simplicity, we have created these as default.

1. Asset (DNA) = 30%

2. Community/Partnerships = 30%

3. Treasury = 18%

4. Team = 10%

5. Liquidity = 10%

6. Impact Program = 2%

THE RDAO ALLOCATION

Default Pie breakdown for RDAO including each DNA. All assets when tokenized in our platform will automatically have the assigned ESH tokens.

Default Allocation:

1 Billion RDAO TOKENS minted on the Ethereum blockchain on October 08, 2020. And 1 Billion rDAO TOKENS minted on the Binance blockchain on June 4, 2021 upon Binance Migration.

1. Asset (DNA) = 30%

2. Community/Partnerships = 30%

3. Treasury = 18%

4. Team = 10%

5. Liquidity = 10%

6. Impact Program = 2%

✔️ 1 Billion RDAO TOKENS was minted on the Ethereum blockchain on October 08, 2020

✔️ Initial USDT value of 1 RDAO token = .022 USDC ($2.2M valuation)

✔️ LIQUIDITY CAP : 300,000,000 RDAO tokens

✔️ TREASURY CAP : 180,000,000 RDAO tokens

- 1 Billion RDAO TOKENS was minted on the Ethereum blockchain on October 08, 2020.

- Initial USDT value of 1 RDAO token = .022 USDC ($2.2M valuation)

- LIQUIDITY CAP : 300,000,000 RDAO tokens

- TREASURY CAP : 180,000,000 RDAO tokens

General Features of The RealtyDao Protocol

Create Liquidity For Your DNA's

Create liquidity for your new TLDS or domain assets by means of tokenization on the Ethereum blockchain.

What is Asset Tokenization?

Asset tokenization refers to the act of turning the ownership of a real-world item into a digital token and in this case, we use our ESH protocol. This can be done in various ways, but all result in the legally-upheld bridge between the physical asset (real estate property, vehicle, gold, etc.) and its representative token. A token is a transferable unit of something. Deeds, titles, and certificates are all traditional versions of a “token,” a symbol or item that represents something else.

A deed to a house represents ownership of that house. “Token” is used to refer to the digitally native asset which represents the real-world asset itself. “Digitally native” refers to how the asset exclusively lives on the internet. Whereas traditional asset ownership like a deed, title, or certificate requires a piece of paper with legal approval, digitally native assets have ownership baked into the asset itself. “

Tokenizing Your DNA

If your DNA is accepted and tokenized using our ESH protocol, the programmatic increase in value is transparent and achieved with utility and app coordination.

When you submit a DNA for marketplace inclusion, two things happen in the DAO governance.

1. Assuming RealtyDao accepts your asset and valuation, Instantly create liquidity for your DNA whether it's with a new TLD by the Handshake protocol or a domain that you own

2. Token holders can vote on proposals and acceptance.

Buy Tokenized DNA Tokens

Our growing RealtyDao community, you gain unique asset ESH tokens using our RDAO liquid backed token.

Increase Value with Assets Using our Programmatic eShares Protocol

Our VNOC Tokenization platform uses a programmatic smart contract protocol that ultimately increases the value of your ESH token linked to verified DNA transactions and interactions.

We look at a variety of factors to try and measure value including:

✔️ Current Liquid Asset value

✔️ Future Potential Value

✔️ Utility /Network Value

✔️ Comps

✔️ Data-/tech Value

✔️ Revenue Value

Voting rights for DNA Tokenization

Joining the RealtyDao community gives you rights to participate in community voting for DNA's that you want to tokenize, develop or liquidate . Perhaps you have an interest in owning a piece of this DNA but as of the moment, it was not tokenized by the owner. Participating in voting for the specific DNA will move it to the ranks of what asset will be tokenized first.

Participate in RDAO Liquidity Mining Program

RealtyDao has invoked an RDAO Liquidity Mining Program on specific DEFI platforms allowing you to mine RDAO tokens by locking in USDT/ETH/DAI/BTC using your favorite wallet. The initial phase is using the partner dAPP wallets with near-future plans to incorporate other wallet solutions.

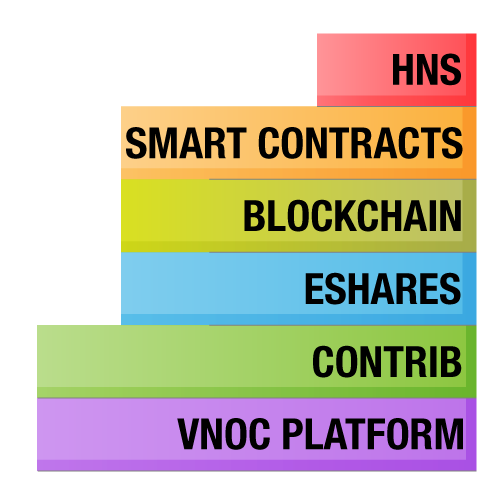

REALTYDAO Building Blocks

REALTYDAO is an aggregation of protocols and platforms:

1. Eshares protocol

2. Handshake Blockchain

3. Binance Smart Chain

4. Defi protocols

5. VNOC OS

6. Contrib protocol (Proof-of-Contribution)

VNOC integration helps DNA’s and protocols more effectively launch, learn from their communities, evolve incentive structures and move to rapidly decentralize and scale organically inside the RDAO network

Finance- Bankless- 100% crypto/stable coins, cold/hot storage wallets, smart contracts- USDC, USDT, DIA, ETH, BTC. 10% created for RDAO Liquidity pool

Operations- Online/Onchain- VNOC OS and CONTRIB

Gamification Layer- Without a gamification layer, Distributed and Autonomous projects eventually come to an end without a circular gamification mechanism. RealtyDAO investment in iChallenge and its leading URL gamification delivery mechanism will be a strategic layer, expanding RDAO assets capabilities with a fun, intelligent gaming system.

Some initial domain focused concepts being discussed include:

✔️ Treasure Hunt- Find any URL with x in y

✔️ Top Traffic URL

✔️ Most Revenue URL

✔️ Best Value URL

✔️ Most Active Member

✔️ Facts/Stats

Developments in Motion include;

✔️ PRChallenge.com

✔️ DevChallenge.com

✔️ CodeChallenge.com

✔️ ChainChallenge

✔️ UXChallenge

GOVERNANCE

RealtyDAO is progressively moving to decentralize and is currently in its hard fork to Binance Smart chain thereby decreasing blockchain and transaction costs.

RealtyDAO members

✔️ are required to hold a min of 10,000 RDAO to participate in REALTYDAO governance.

✔️ Vote in Realtydao governance topics

rDAO LIQUIDITY MINING PROGRAM

In order to incentivize the growth of the RDAO, the community has launched a liquidity mining program. In the program, owners can stake TLD’s in order to earn more RDAO.

We will be implementing smart liquidity pools across Uniswap and other top DEX's and AMM's that serves as an automatic buyback machine, token issuance pool, and liquidity provider platforms for rDAO.

The first 12 months the liquidity mining program is offering a percentage of the RDAO liquidity cap per month that will be distributed among stakers, Contributors, and liquidity providers

LOCK-UP PERIOD

Stakeholders will have a percentage of the pool and the equivalent RDAO tokens to use within the platform providing they will not trade their RDAO tokens anytime within the approved lock-up period. RDAO has various lock-up periods to spread out so liquidity market makers are in check with growth resource utilization.

Decentralized TLD’s

Decentralized TLD’s

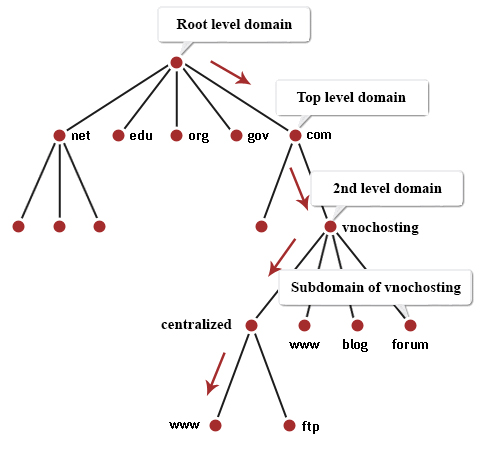

Top-level domains are at the highest level in the hierarchical Domain Name System of the Internet. The top-level domain names are installed in the root zone of the namespace.

HANDSHAKE BLOCKCHAIN - THE NEW TLD NAMING PROTOCOL

Handshake is a UTXO-based blockchain protocol that manages the registration, renewal and transfer of DNS top-level domains (TLDs). HANDSHAKE'S naming protocol differs from its predecessors in that it has no concept of namespacing or subdomains at the consensus layer. Its purpose is not to replace DNS, but to replace the root zone file and the root servers.

DNS hierarchy

Handshake is the only protocol that works to replace the ICANN root server. By doing this, the resolvers point to an authoritative name server configured to the blockchain rather than ICANN’s root zone file. This enables Handshake to issue new TLDs that live on top of existing DNS. Any owner of Handshake domain names gets a cryptographic key which provides the owner the ability to create signatures signed by the owner’s key.

This creates a trustless system that does not rely on Certificate Authorities, minimizing the risk of bad actors creating redirects, phishing attacks, and spying on your traffic.

The new internet is now allowing you to buy/own for eg. myname/ cherrytops/

Current Goals

Current goals of RDAO are to add utility and grow adoption of RDAO token and become a DAO member and DAO asset holder. To do this, we have a few initiatives below that you can help contribute to depending on which areas interest you the most.

If you'd like to contribute to any of the initiatives below, just place a message in the respective Discord channel to get involved. These initiatives are created from community members on what they think are the most important tasks for the coop during each initiative's call.

Initially on UNISWAP with a RDAO/ETH, RDAO/BTC will move on to other platforms such as Balancer.

PROTOCOLS USED

RoadMap

PHASE 1

- Develop DAO governance within the DAO code structure

- Streamline Token Transfers among assets

- Create the multi protocol platform

- Integrations of permissionless token exchanges

- Liquidity Mining Program on Uniswap and Balancer

- DEX Listings

PHASE 2

- Adding Class Liquidity Pools

- Security Vaults for HNS TLDS

- Multi-Chain operability

- DNA Asset Trading

PHASE 3

- Pre-ICO Token Sale

- Staking and Mining Contract Development

- Monetization Apps for DAO’s

- Incoming DAO governance

- Adding Class Liquidity Pools

- Security Vaults for HNS TLDS

- Multi-Chain operability

- NFT DNA Asset Trading

- NFT Marketplace

- Airdrop

PHASE 4

- Smart contract Audit

- Listings on Major Centralized Exchange

- Large influencer marketing push

- Expand Marketing and Contributor Team

- Incorporation and Company LLC App for DAO’s

- Popular Website DAO app integrations (Wordpress, Shopify)

- Multi Chain Development

- Liquidity pools on Binance smart chain

- rDAO liquidity pools on top Binance exchanges

- Farming pools on Binance Smart chain for rDAO and DNA’s

- Decentralized Exchange of digital native asset tokens

- Vertical liquidity pools of DNA’s

Are RDAO Securities?

Are you buying stake in Static TLD or Claim on Future Revenues?

Why did you acquire the patent?

Risks - RealtyDAO is an early and highly speculative opportunity. Do not participate if you do not have the capacity and you are fully aware this project could not succeed and be worth 0. Please inform yourself on the risk of investing in this asset class and project. Thank you for your time and Interest in RealtyDAO.

RealtyDAO is unique with our ability to lean in to DEFI by leveraging the 20,000 premium and historical DNA like Referrals.com, Applications.com, eShares.com, and others. Utility drives Price and is one of the first steps to get aggressive and compounding value vertically and horizontally by leveraging key software tool sets within Assets.

Our circular and transparent structure gives our members confidence with their time while adding value to their investments.

With RealtyDao, you can

✔️ Grow a pool of virtual real estate assets.

✔️ Own a claim of premium RealtyDAO tokenized Digital Native Assets.

✔️ Send a proposal to add your DNA for tokenization and into our defi blockchain platform

💠 High Retention - Retention is high for current and new members, and each member feels like they are effectively contributing as a member of the community.

💠 Effective - There is a vibrant community of RDAO members who effectively contribute and focus on the right goals.

💠 Autonomous - RDAO members attract new members and self assign each other to roles helping move the Coop forward.

💠 Enticing - Incentives for joining RealtyDAO are clear and enticing, which lead to high retention and member acquisition.